At the end of 2023, huge changes were announced to the NHR tax incentive for those immigrating, relocating, or moving back to Portugal. These changes impact the way that many emigrants, immigrants and expats will be taxed going forward.

If you’re planning to move to Portugal, it’s important you evaluate the tax implications to your income, investment, and retirement funds to make sure the move here is something you can afford long-term.

The End of NHR as we knew it.

The existing NHR regime ended on December 31, 2023. Those who already had NHR status or applied prior to December 31st, 2023 were grandfathered in. So, if you already have NHR, nothing changes for you. However, starting on January 1, 2024, the new NHR regime (“NHR 2.0”) began with a new focus, different eligibility, and a host of new rules.

So, what now?

Well, you may qualify under the limited qualifications remaining for NHR or the new Tax Incentive for Scientific Research & Innovation.

The most important thing you can do is reach out to a tax strategist who:

a) can see if you qualify under the new NHR rules and

b) understands Portuguese tax law, tax strategy, and its implications on your income, investments, or retirement funds.

You’ll want your tax strategist to map out what your tax burden will look like with and without NHR so you can determine whether you can truly afford to make the move to Portugal or to stay long-term.

You can also search for “Tax Calculators Portugal” to estimate what your taxes might look like or try Fresh Portugal’s tax calculator (I’ve never used there service so this is not an endorsement but rather a resource).

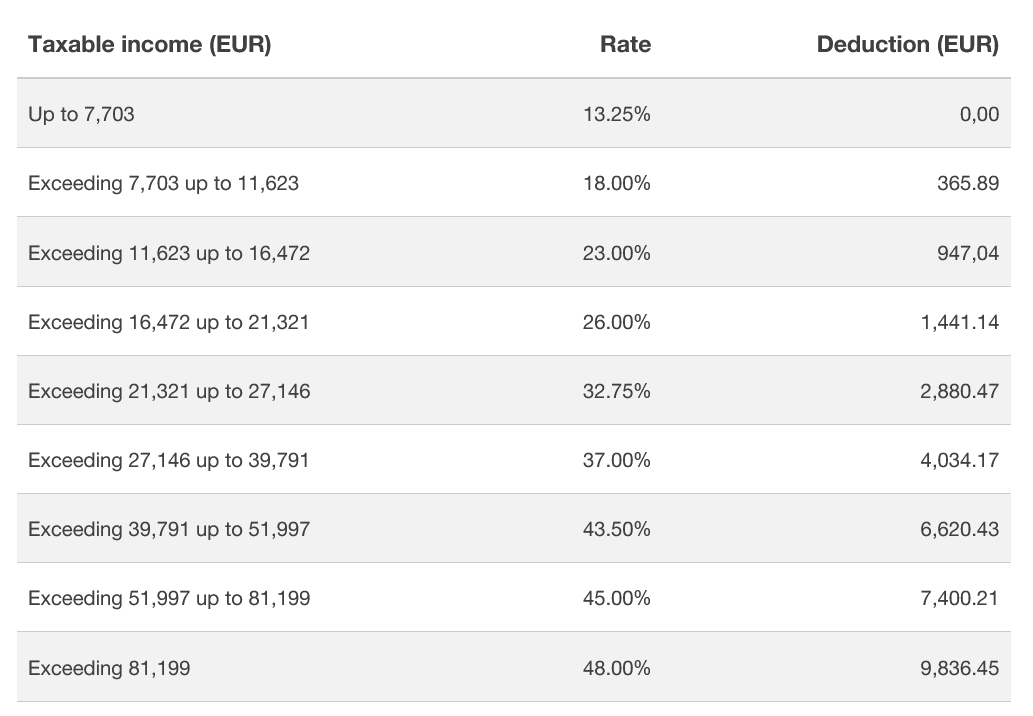

Here’s a look at what the current tax rates are in Portugal (without NHR)