Step-by-Step Process for Purchasing Property & Getting a Mortgage in Portugal

We’ve covered the differences between a traditional realtor and an independent real estate consultant/buyer’s agent and talked a little about the fees associated with purchasing a property + the challenges of buying real estate in Portugal.

Today, we’re sharing the actual steps for buying a property and applying for a mortgage in Portugal.

One VERY VERY VERY VERY IMPORTANT thing to note: Unlike in the United States, you do not have as much opportunity for working directly with a seller or for researching properties yourself.

As mentioned in the previous email, there’s no MLS, Zillow, or easily obtainable comps to understand what’s available or the market in general. And, because of the commission set-up, realtors hide listings from each other, so it’s hard to see everything that’s available on the market at any given time.

So, the VERY IMPORTANT thing to note is this – if you contact the seller, seller’s agent, or a developer directly (meaning, without a traditional realtor or independent consultant calling on your behalf), you GIVE UP YOUR RIGHTS TO REPRESENTATION ON THE DEAL.

It’s absolutely bonkers!

But the fact is, once you reach out to a seller or developer directly, you can’t have a realtor come into the picture to represent you for a commission as you have technically just represented yourself. It’s a messed up system. In the same way, if you go to a property with a realtor to represent you and you end up not wanting to work with that realtor, you can’t switch realtors on that particular deal. The realtor basically owns you as their client or lead for that property (we learned this the very hard way and this realtor attempted to block us from buying any house in this one development when we didn’t want to continue working with her).

So, be wise! If you find a property you like online, have a traditional or independent agent (that you already know and like) call on your behalf or have your real estate attorney do it so that you have some support in this less than transparent process in Portugal.

This is not to say you can’t represent yourself. Of course you can and you’re free to negotiate on your behalf too. Just make sure you bring your real estate attorney into the deal from the beginning then and make sure your attorney doesn’t need/want a commission on the deal because once you’ve called a seller, their agent or a developer directly, the commission to a buyer’s representative is off the table.

With that said, here are the steps to buying property in Portugal.

1. Find a Real Estate Consultant or Agent – As we discussed previously, regardless of whether you choose an agent or a consultant, you need to find representation you can trust. They will help you with the property search, scheduling showings, communicating with the seller’s realtor or property developer, finding a mortgage broker, negotiating price, making the offer and the list goes on. So, the first thing you want to do is find a real estate consultant to represent you.

Again, we recommend working with Antonio Mira, +351 917 944 262 . What’s great is that he includes setting you up with your NIF and your Portuguese bank account as part of his service package which totally eliminates that headache right off your to-do list for applying for your visa.

Because we’ve been working with Antonio for so long and we know first hand how hard it is to find an affordable rental or home purchase, we asked Antonio if he would give our community a special discount on his services.

So, if you do end up calling him, let him know you found him through Everyday Portugal and he will give you a $500 discount on his services.

After the negotiation he did with our first lease and the savings he was able to get us by getting us a much lower interest rate on our mortgage than the bank or mortgage broker was offering, we can honestly say that his service is worth every penny! In the end, the savings he provides pays for the service itself and then some.

Note: If searching for an agent yourself, you’ll want to insure they have a valid license. All estate agents in Portugal are required to have an AMI license issued by the IMPIC (a government agency in Portugal) Each estate agent is issued a license with an individual number; usually displayed on their website and at their premises. To confirm an agent’s license is valid, you can check yourself on the IMPIC website .

2. Hire a Real Estate Attorney – while some real estate consultancy and agencies have a real estate attorney on staff, many do not and will usually recommend one or two firms that they trust for you to hire an attorney from.

A real estate attorney is helpful for confirming that the sellers actually own the property they are selling, that the property is a legal build, that there are no existing debts attached to the property and that your CPCV protects you as much as it can.

Real estate agents on both sides of the deal will often try to convince you to let their in-house attorneys draft and review the CPCV as a “free” service to “save” you money so you don’t have to hire an attorney. WE ABSOLUTELY DO NOT RECOMMEND THIS. Neither agent on either side of the deal will make sure the CPCV is written to protect your interests – they just draft a templated CPCV which generally protects the sellers and the agents more than the buyer.

We recommend, instead, that you hire an independent real estate attorney to draft the CPCV and to make sure there is language in it that protects you if you need to cancel the CPCV due to financing or issues with the property itself.

We worked with Joao Goncalves +351 917 149 329 (WhatsApp) as our real estate attorney. He is relentless at protecting your interests when reviewing or creating a lease or purchase agreement. He goes over these contracts with a fine tooth comb and will make sure you get ironclad protection. Both CPCVs given to us by the sellers’ agents on two different deals were riddled with issues and only protected the sellers’ interests. Joao was so annoyed at how they were trying to take advantage of foreigners who didn’t know the system that he insisted he draft a new CPCV and in there wrote several clauses that provided us the maximum protections under the law. These clauses are clearly not in the basic version of the CPCV that different agencies use. So, get yourself an independent attorney to represent you but we highly recommend reaching out to Joao first as he’s vetted and we’ve been working with him and his firm for 2 1/2 years now. They’ve made every part of the transition here and all legal and government dealings headache free and easy peasy. We trust them wholeheartedly so give them a call.

3. Apply for your NIF number (if you don’t have one already) – A NIF number (or Número de Identificação Fiscal) is your Portuguese Tax Number. Your real estate attorney, an independent service or an agent like Antonio Mira, +351 917 944 262 can submit the application for a NIF on your behalf. It is also necessary to have one to open a bank account in Portugal so it’s an important number to get. You will need your NIF number in order to sign the CPCV (purchase contract) for the property you want to buy and for signing the deed. You can also do it yourself but having someone do it for us made it a stress-free process because we didn’t have to worry about making any mistakes.

4. Get pre-qualified for a loan – if you work with Antonio, he’ll be able to help you find the best mortgage rate and to get you pre-qualified for a loan. The lending process here will make you want to pull all of your hair out. Doing most of the work up front by getting pre-qualified will speed the process along and will let you know how much home you really can afford. As foreigners, we have to put a lot more cash down for the down payment than we would as citizens AND they don’t lend on the full amount of the appraised value. You can plan to be putting down anywhere from 30%-50% of the sales price in cash when it’s all said and done. Lending practices in Portugal are much more conservative than what we’re accustomed to so prepare yourself for that. Getting pre-qualified for a loan will give you the best indication of what price range you’ll want to stick to and will speed up the lending process which often takes 3-4 months or more to complete. Banks do not move fast in Portugal and are fraught with red tape.

Here’s how to qualify for a mortgage in Portugal:

Banks check two primary criteria for processing a mortgage request.

1. Your financial health/overall picture

2. The property evaluation

Getting a mortgage in Portugal is slightly different than qualifying for one in the United States. To assess the mortgage amount the bank will offer, the bank requires proof of income and earnings. They will take into account your salary, investment income, pension income, dividends received and rental income.

Banks value your employment history and will also assess your debts. It is slightly more challenging to receive a mortgage in Portugal than it is in the United States as your assets and total net worth are not as important as your current income and employment status.

For example, you could have 10 million dollars in the bank but if you’re not earning consistent income from the income sources mentioned above, you may not qualify for a mortgage even though you could likely buy a property in all cash.

In addition to looking at your financial picture, the bank you choose to provide your mortgage will require a property evaluation. Usually, Portuguese banks lend between 60-80% of the property’s appraised value.

To get started, here’s what you need to provide the bank to obtain a mortgage:

· Your credit report – not just the score but the entire report

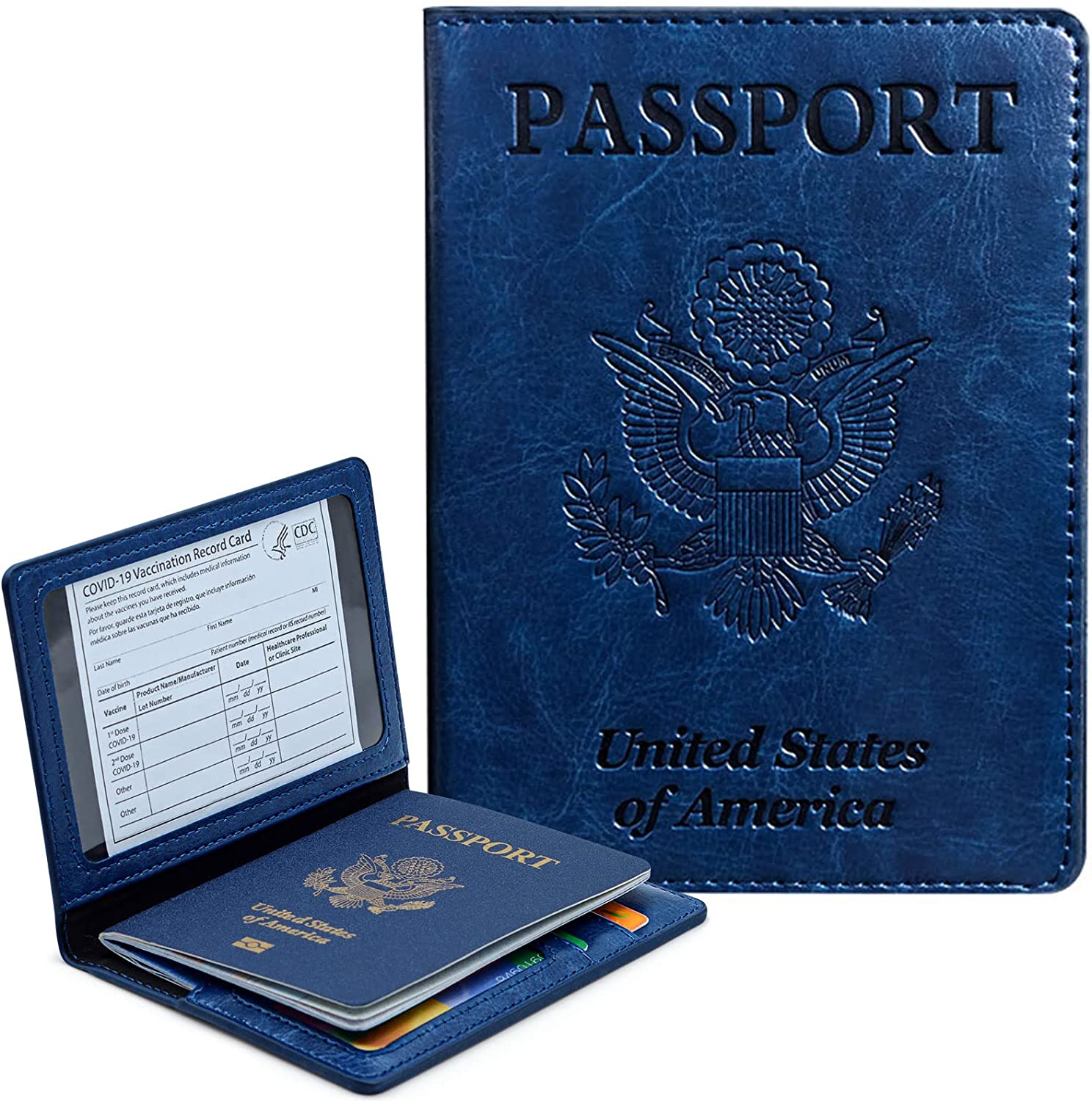

· A copy of your Passport

· A copy of the Portuguese Tax Number (NIF)

· Proof of address, for this, the recent utility bill works

· Recent pay stubs

· Recent bank statements

· Your most recent tax return

Sometimes, banks will also require a copy of the tenancy agreement and other documentation they feel they need to make an assessment.

APPRAISALS

Portuguese banks will often only lend on 60%-70% of the appraised value of the home to foreigners. If you are a Portuguese citizen or the bank qualifies you as a fiscal resident, you can sometimes get a mortgage on 80%-90% of the appraised value.

The term “appraised value” is important. In Portugal, the bank determines the appraised value based on the legal, livable space in the property. The legal, livable space is determined by how much home is allowed to be built on a property.

For example, in some cities, one can build a home with livable space that amounts to 5% of the size of the property. So it is common for Portuguese property owners to build homes with plans that show the legal livable space to fit the requirements but the plans also include a very large “garage” or “storage” space as well (which doesn’t count against their 5% building cap). So, after the plans are approved, the build finished, and the final inspection done, Portuguese homeowners will often build out the rest of the home within that garage/storage space that was on the plan. What this means though is that you can’t get a mortgage on the entire property but only on the legal, approved portion of the property.

Unfortunately, it is common for Portuguese properties to have illegal builds on them; meaning that only a portion of the property will qualify to be appraised. Make sure you have your real estate consultant or attorney confirm how much of the property is legal and will be eligible for the appraisal so you understand fully the max amount the bank will be willing to lend to you.

INSURANCE

Something important to note: In Portugal, home AND life insurance are often required in order to receive a mortgage loan. Banks usually provide quotes for the insurance costs so you’ll know the full monthly payment including mortgage, taxes, fees and insurance. Rarely, but sometimes, banks will allow your life insurance to count for the mortgage in lieu of having to get extra life insurance within Portugal.

TAXES & FEES

The main cost that you will have to pay is the IMT transfer tax (ranging from 10% for non-residents under the NHR plan to 0% for those buying a cheap property as a second home.)It is a good idea to speak with a real estate attorney or tax attorney in Portugal to understand what the taxes & fees will be based on your unique situation.While fees relating to your agent will be paid by the seller, there are a few fees and taxes that you may be responsible for paying. These are:

· Notary & Land Registry Fees ranging from 0.2 percent to 1.2 percent of the property value.

· The Stamp Duty which is currently 0.8 percent of the value of your home.

· Imposto Municipal Sobre Transmissões (IMT) which is the Property transfer tax. This tax is determined based on the cost of the property and whether the property is for a first, second or third home.

While the process of getting a qualifying for a is relatively the same as in the U.S., you’ll want to take note of the differences that are specific to Portugal. We highly recommend you work with Antonio Mira or an idependent mortgage broker to help you shop for the best rates and offers across several banks.

5. Search for Properties – your real estate consultant can find available properties for you but it doesn’t hurt to peruse websites like idealista or local real estate agency websites (like remax , ERA , Keller Williams , etc.) yourself too. As mentioned before (and important enough to reiterate), don’t call on the properties directly. It’s a crazy set-up in Portugal but if you contact a seller’s realtor or a property developer directly about a property, you have given up your right to independent representation on that property. That means that only the seller’s agent or the developer will represent you. Your real estate agent can not represent you, protect your interests, nor receive a commission on that property. So, if you want representation (which you do!), make sure you have your real estate consultant or realtor reach out to the seller’s agent or developer first.

6. Visit the Property – Make sure to visit the property or have your agent do a complete video tour with comprehensive notes on the property. If you like what you see at first glance, we highly recommend hiring a home inspector.

While that would seem like a completely normal thing to request if you’re from the United States, in Portugal, home inspections aren’t common. We even ran up against sellers who were personally offended that we wanted the home inspected.

A mantra we heard from more than one homeowner whether it was on price, what we wanted to stay with the property, or getting an inspection was, “Don’t you trust us? We’re good people.” They believed that questioning anything about the home or property was questioning their integrity. We were also told by different realtors that we should be careful when negotiating on the price because “you do not want to offend the seller or the seller’s agent.” Since Portugal is a relational culture instead of a transactional culture, many business transactions here require a lot of emotional handholding in order to get things done.

However, even though getting an inspection isn’t common, you’ll want to do it. In one home we looked at that was absolutely gorgeous aesthetically, we discovered through the inspection almost $100K in repairs we’d have to make due to deferred maintenance. It’s definitely worth investing in an inspection. The inspectors here who are thorough charge a lot. Plan to spend a lot more than you would in the States on an inspection. It can save you from a larger financial error though so it’s worth it.

7. Make an Offer on the Property – once you’ve found a property you like, your real estate consultant will submit an offer to the seller’s agent. The initial offer will include the following:

1.Your offer

2. The date you are willing to sign the CPCV (purchase contract)

3. The deposit you are willing to make to secure the CPCV (typically 10-20% of the purchase price. Both homes we placed offers on accepted 10% down.)

4. The date you will sign the deed

5. Any other conditions you’d like to add. For example, if you want inspections and the terms of the inspection, if you’ll be waiting on the bank to approve a mortgage, the date you’re interested in closing on the property, a request for a final walk-through, or any repairs that you’d like made beforehand. Also, if you want certain things to stay in the house and what things you definitely want to be removed from the property (sometimes people in Portugal will sell their house and leave you with a bunch of broken appliances or old furniture that they didn’t want to take with them so be clear on this in your offer so you don’t have to pay to have these items removed or have to go through the hassle of selling them yourself). All of this, you can run by your agent or attorney to include in the offer. They can help make sure you haven’t forgotten anything.

8. Sign and submit the CPCV and Deposit to the Seller – once the buyer and seller’s agents are finished negotiating a price you agree upon, you’ll accept the offer, sign the CPCV and submit it and your deposit to the seller. You will want your real estate attorney to review the CPCV to make sure your interests are protected.

The CPCV (Contrato de Promessa de Compra e Venda) is the promissory contract that confirms that you will move forward with the purchase.

Once the CPCV is signed by both parties, it makes it difficult for both the buyer and the seller to pull out of the deal. While the CPCV isn’t a legal requirement, it’s a good idea because it gives you time for inspections or obtaining a mortgage from the bank while keeping the seller from accepting other offers. In fact, once you sign the CPCV and give the seller your deposit, the seller would have to pay you twice your deposit in order to break the contract…making it very unlikely the seller will pull out of the deal.

However, if you’re an all cash buyer or the property is new and doesn’t require time for inspections, you can go straight from the price negotiation to signing the deed (escritura). While signing the deed can save you some money on legal costs, it may offer you less protection within the deal so we suggest you do a CPCV to lock up the deal first which is why we’re going to focus on what goes into a CPCV today.

Up until the point that CPCV is signed, it’s easy for the seller to pull out of the deal (which happens frequently). So, here’s what you want to include in the CPCV:

a) Names & Details of the Buyer & Seller and their representatives

b) Description of the Property: including the habitation license and registration number.

c)The agreed upon sales price

d) Deposit amount: you’ll typically need to put down a deposit (sinal) to show good faith on your intention to buy. While there’s no fixed amount that is required for the deposit, 10% of the purchase price is the typical amount offered. In terms of protecting your deposit, you’ll want to have your real estate attorney include a clause that says if the seller pulls out, the seller has to return twice the amount of the deposit. You’ll also include how the deposit will be paid.

e) Protection Clauses: Your real estate attorney should include all the instances in which you’d be able to pull out of the deal without penalty. For example, if the appraisal comes in too low, if the bank won’t approve a mortgage that works for you or if an inspection uncovers a major problem with the property.

f) Items included in the sales price: You may have negotiated furniture, fixtures or landscape elements in the sales price of the property. Make sure those are clearly detailed in the CPCV. And list out items you want removed from the property before the deed is signed as well. It’s not uncommon for sellers to remove everything from the house or to leave a bunch of stuff you don’t want in the house. Make it clear in the CPCV what you want to stay and what should be removed.

g) The date when the deed will be signed. You’ll also want to include a clause about what happens if there’s a delay in the deed being signed.

h) The date you want the seller to be out of the property by.

i) Any other conditions to the sale that each party must meet before the deed is signed.

We can not stress this enough – make sure you have a trusted real estate attorney review the CPCV to make sure everything you need to protect yourself is in there as well as all the terms you agreed to with the seller.

9. Transfer of the Deed – Once all the terms of the CPCV have been met, you’ll sign the deed and it will be transferred to you in a Notary office. This is when you’ll officially own the house and get your keys. Both the seller and buyer and their agents will be present at the signing. If you are getting a mortgage to purchase the house, a bank representative will be present as well. You are able to give Power of Attorney to someone to sign the deed on your behalf if you are unable to be physically present. Usually, this is your real estate attorney. Special note: If Portuguese is not your first language, you’ll want someone at the meeting who can translate for you. Likely your real estate consultant or attorney will suffice.

There were 9 people in the room when we signed our deed – kind of a circus and pretty funny because it felt like the town cryer was in the middle of the village announcing our home purchase to the world. Just another cute thing about Portugal!

Again, another LOOONG post but we hope you found these resources helpful and we wish an easy and tranquil home purchasing process. Learn from our mistakes, friend! We are better armed for our next purchase after doing it all wrong at first and we want you to benefit from our experiences.

Até próxima,

Everyday Portugal

ps – we’d love to hear from you and keep our coaching series as up-to-date as possible. If we have missed any crucial information that would be valuable or if there’s a topic you’d really love us to cover, please email us using the contact form below.

Grab Our FREE "Moving To Portugal" Coaching Series

This simple, step-by-step email series will walk you through the most crucial to-do’s for moving to or investing in Portugal.

Get how-to’s plus important resources for Visa/Immigration, Banking in Portugal, Relocation & Real Estate, Finding a Job/Creating Passive Income, Learning Portuguese and more! Plus, get access to our FREE Members’ Resource Library.